How Blockchain and Web3 Can Fix Carbon Credits Issues?

In this article, we will first understand the basics of carbon credits and carbon offsets in the real world. Then, we will discuss the flaws and limitations in the existing carbon trading systems. And understand how blockchain technology, crypto and web3 can help in solving these carbon credits issues.

Carbon Credits in the Real World

As they exist in the real world, carbon credits can be either compulsory or optional. Carbon Credits or Carbon Emissions Trading Schemes are a mandatory and market-based incentive architecture for reducing overall carbon emissions. These are also known as Compliance Carbon Markets (CCM). This is because government orders make them mandated/compulsory. The valuation of CCMs was $850 Billions in 2021.

Carbon Offsets or Voluntary Carbon Markets (VCM) are not mandated/compulsory. Any individual or organization that wants to reduce their carbon footprint can buy such voluntary credits or offsets. The valuation of VCMs was only $1 Billion in 2021. So you can clearly observe the great difference in the scale of CCMs and VCMs. It shows how making something compulsory and mandated by the government leads to fast adoption.

Compulsory Carbon Credits

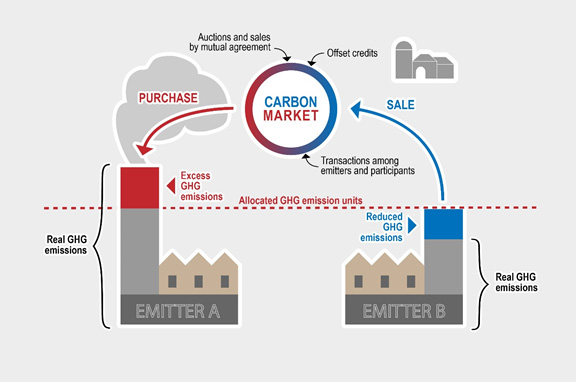

Entities in a CCM system which pollute or emit greenhouse gases or "carbon" above prescribed limits must pay money and buy carbon credits. Government bodies mandate these emission limits in a given jurisdiction.

The idea is to reduce these limits or caps progressively over the next years. This is to keep the industries in line with emission reduction goals. Other entities which pollute lesser than allowed get to sell these credits or "pollution permits" and earn money.

This system is called as "cap and trade" for the limits (caps) and the buying and selling of credits (trade). It can ensure that any given industry as a whole stays within the specified pollution limits. Also over time, it keeps reducing the total pollution by transitioning to cleaner processes.

Optional Carbon Credits

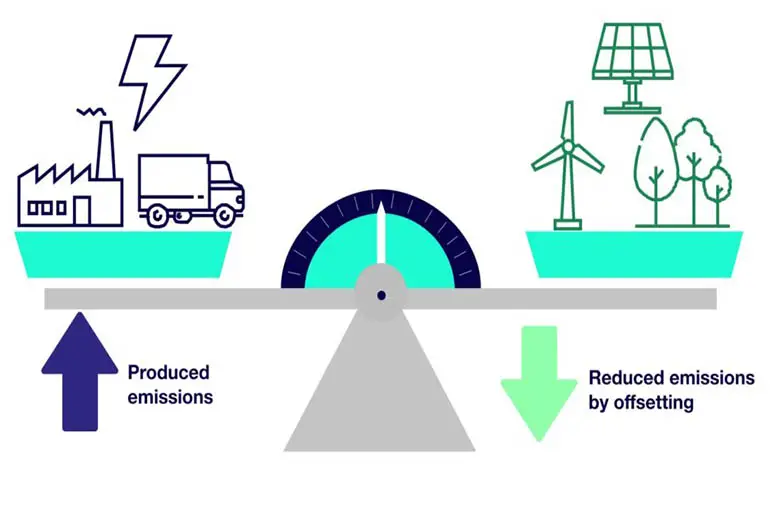

You can adopt green energy and eco-friendly lifestyles like local commerce, avoiding flights, using electric transport and solar/wind energy. In this case, you are directly reducing your carbon footprint by incorporation nature-friendly activities into your life.

But you can also fund and support projects like reforestation, natural conservation, or carbon capture and removal technology. Here, you are offsetting or indirectly reducing your environmental impact by contributing your money to activities that are actually reducing or preventing carbon emissions.

In exchange for your monetary contributions, you get "carbon offsets". In other words, you are buying these carbon offsets which have a negative carbon footprint. By putting them on your "carbon balance sheet", you can show that you have reduced your net impact on the environment. So you can spend your money to buy carbon offsets equal to your actual carbon footprint. And then claim to having "net zero emissions" or being "carbon neutral".

Earning Carbon Credits

Any entity that carries out eco-friendly projects that prevent or reduce carbon emissions, can take the help of carbon trading monitoring bodies to receive carbon credits for their good work. It can involve a lot of paperwork, audits, scientific measurements, commissions/fees, and waiting time.

But once the formalities are done, your eco-friendly activities become a source of revenue, giving you both peace of mind and money for contributing in solving climate change. You can sell your earned credits immediately in the carbon markets and monetize them.

People expect that the average price of a carbon credit deserves to be $100, whereas now it is barely $3-10 right now. So you can save these carbon credits as an investment and sell them in the future when their prices will appreciate in the markets.

Problems with Carbon Credits and How Blockchain/Crypto/Web3 Can Solve Them

In theory, carbon credits help to reduce carbon emissions, punish entities doing activities that are harmful to the environment and reward the beneficial actors who are eco-friendly. But since they were first introduced in 1997 with the Kyoto Protocol, many discrepancies and unintended harmful consequences of carbon credits have come to light. Turns out that the real world is too complex and human behavior is too tricky. Misuse and abuse of carbon credits has happened, resulting in more carbon emissions being emitted, wrongdoers making windfall profits, and good actors and innocent communities left to bear the burden.

Let us dig deeper into some major problematic aspects arising from the oversimplification of carbon credits and their imperfect implementations. And how we could apply blockchain and crypto technology to make carbon credits stronger and useful for solving climate change in a fair and effective way.

#1 Climate Change Problem is Global, But Carbon Credits Are Not

First and foremost, let's talk about Global North and Global South. The developed, industrialized countries comprise the Global North, standing for high consumption rates and advanced infrastructure. Their progress has come at the cost of carbon emissions. While the global north reaps most of the rewards, their environmental impact causes global warming and climate change which affects everyone. And the most affected ones are those who cannot defend and adapt against these drastic changes. They are the underdeveloped and impoverished parts of the world, which are also known as the Global South.

Carbon Credits Do Help

Carbon Credits can solve these inequities in the climate change impacts on global south. It can be cheaper to use labor and land to conduct eco-friendly activities like preserving forests and peatlands, regenerative agriculture or organic farming, solar and wind farms etc. By preventing carbon emissions from occuring as well as absorbing existing carbon emissions through these projects, the global south can earn carbon credits and generate revenue. This is being done and many farmers, landowners and environmentalists are getting support for their good work. But there is also the flipside.

But Carbon Credits Harm As Well

Compulsory carbon credits or Compliance Carbon Markets (CCM) have been developed mostly in Europe, North America and Australia. They are absent in a majority of the global south. Due to this, the cheap land and labor that can be attractive for eco-friendly projects, is also attractive for polluting industrialized activities. Industries from the Global North, faced with compulsory caps or limits in carbon emissions, can move their most polluting activities to the Global South, where carbon tax or carbon emission caps are relaxed or absent.

Then they can show that their factories in the Global North have become cleaner and reduced emissions than earlier, and earn carbon credits for this. But in reality, their overall emissions have gone up, as they produce more and pollute more at lower costs in the Global South. Thus, carbon credits end up profitting the pollution makers. And local pollution in the global south goes up spoiling the natural environment and people's health over there.

Crypto Solution for Global Carbon Credits

As you can see, all this happened because carbon credits markets, especially the compulsory ones, are not implemented equally everywhere. This fractured implementation of carbon trading leads to arbitrage opportunities for polluting industries and helps them, rather than helping to solve climate change. We need the "cap and trade" mechanisms to be implemented globally and equally. Now, crypto markets are by their very nature, cross country, borderless and global, operating 24/7. Thus, they can serve as an ideal platform for implementing global carbon credit markets.

Summary: Climate change is global, but carbon credits are not everywhere yet. Lots of arbitrage opportunities exist to skip carbon taxation/penalties by shifting polluting processes to the global south. Crypto market can help address this being borderless and global by its nature.

#2 Carbon Credit Markets Have Liquidity Issues and Are Not Efficient

Carbon credit markets called Emission Trading Schemes (ETS) exist in different parts of the world. The European Union ETS (EU-ETS) is the best one, with good liquidity and many market participants, relative to other carbon markets. This helps it to reach efficient pricing, keep transactions costs low, and attracts traders to carbon commodities. But most carbon markets are thin and illiquid. This means if you are willing to sell at a given price, you might not find buyers easily. So you will either be forced to sell at a much lower price, or try waiting longer for the right buyer to come along and trade with them later.

With global crypto tokens for carbon credits, the total number of credits goes up. It is not restricted to a given region where the carbon market is active. And DeFi protocols can allow for pooling a lot of differently priced carbon credits. As we will see later, the cost of saving or removing 1 ton of carbon has a huge range, based on the location and process that is used. So, the cost of different carbon credits is different. But by staking/locking these variety of carbon credits into a crypto liquidity pool, and swapping with a new token that carries the average price, we can reach efficient pricing and good liquidity.

Summary: Most carbon credit markets are illiquid/thin. So it is not easy to trade them, and efficient pricing is not reached. By tokenizing carbon credits into crypto tokens and making liquidity pools with them, this situation can be improved.

#3 Carbon Trade Isn't Public and has Gatekeepers and Middlemen

In the legacy carbon credit markets, you need to be an active market participant to see the information on the carbon credits. Disclosure of information is restricted from the general public. Data about clients and their transactions is kept in centralized databases which retail traders and brokers administer. Carbon credit transactions therefore happen more through private conversations rather than using trading tools. And the brokers and traders get to charge and keep heavy commissions for facilitating these trades. This means the actual owners of the carbon credits get less control over their assets and get suboptimal prices for them, making the carbon credit markets unattractive for many.

Now imagine instead, that we use public blockchains to record all information on carbon credits, their owners and the transactions. We benefit from carbon credits being accessible to all public equally, transactions being transparent increasing trust in the markets, and carbon credit owners getting optimum prices for their assets. This removes many bottlenecks and overheads in wait times and costs in accessing information as well as conducting trades. Thus, decentralization of carbon credit databases will open up the markets for entire public and democratize carbon trading. Public blockchains will also serve as the foundation that attracts many Web3 and DAO projects to innovate and fix other issues with carbon credits.

Summary: Democratization of carbon markets is yet to happen. For now, it is controlled by a few middlemen and gatekeepers. Even if many are well-intentioned, the lack of players brings added costs, longer waiting times, and lack of transparency in the market. Public blockchains and DAOs can turn this situation around and lower the barriers to entry.

#4 All Carbon Credits Are Not Actually Equal But Get Treated Like That

Carbon credits are heterogeneous, that is their quality and price is extremely varied. Yet due to oversimplification, we still count any given carbon credit as 1 carbon credit regardless of their costs and quality. This can lead to dark tactics like "greenwashing" and "creative accounting". Here companies can buy cheap, low quality offsets to easily become "carbon neutral" on paper. On the other hand, carbon removal and sequestration projects that are actually impactful incur greater costs for execution. But they receive no buyers and therefore lesser prices than they deserve for their carbon credits because the market is already flooded with cheap, low-quality or meaningless carbon credits.

To address this heterogeneity in carbon credits, we can use non-fungible tokens or NFTs instead of fungible crypto tokens. They are great solution to represent the variety in the quality and costs of different carbon credits. NFTs with rich metadata will convey a lot of information on the projects and activities these carbon credits represent. We can give premium looking artwork or media unique to the NFTs. So they can represent for example, the innovative new carbon removal technologies, or nature conservation projects in remote locations. This will make it easier to market them to interested buyers who wish to fund novel projects as angel investors. Such support can bring new & better techniques to the economies of scale needed to implement them in more places.

Summary: To address the heterogeneous nature of carbon credits, we can use Non-Fungible Tokens or NFTs to differentiate and highlight their unique points. NFTs can help the carbon credits for cutting edge carbon removal techniques or difficult conservation projects to get good investors.

#5 Accurate Measurement of Carbon Impact of Projects is Really Hard

Complexity in the real world creates challenges in assessing the impact of any project. For factories, it can still be relatively easy, using sensors for monitoring emissions from various outlets. But in the real world, both the supply chains and natural processes add lots of complexity and feedback loops, with second-order and third-order effects coming in. Such scale and complexity makes direct measurements difficult. In the case of natural projects, measuring how much carbon is trapped in forests or peatlands is not possible directly. Many samples from the soil, air, trees etc. are taken manually and then extrapolated to calculate for the entire project expanse. Predictive models with past data on similar projects can also be used for making estimations without taking any measurements at all.

Such challenges in measuring carbon emissions or savings can become loopholes that entities can exploit. They can cherrypick the most optimistic samples or parameters for models to get great estimations and earn more credits than they deserve. Or vice versa for showing lower emissions. Companies or auditors can deliberately rig the measurement processes to give favorable results. Not to forget, wherever there is human intervention, the appointed authorities can be bribed to fudge reports or look the other way and give clean chit to low quality projects.

Sensors, Oracles and Smart Contracts to the Rescue!

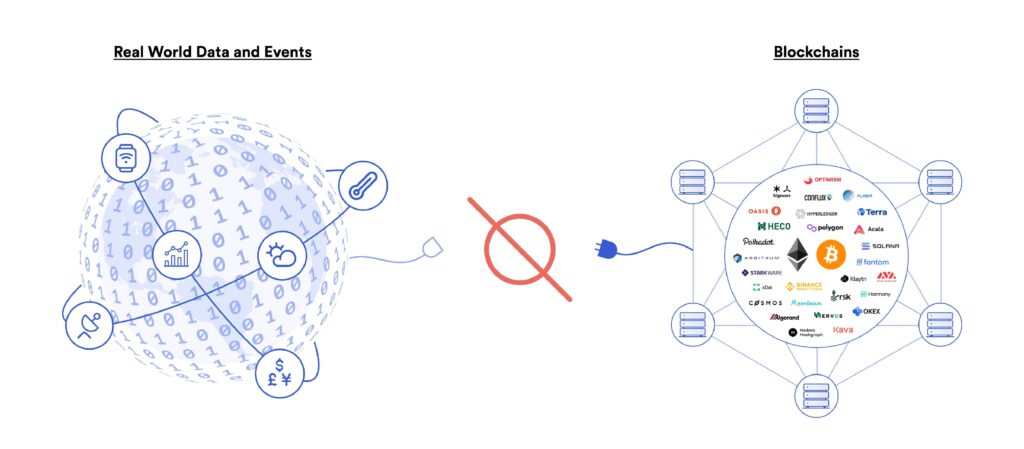

We can devise smart, automated and real-time solutions comprising sensors/IoT devices, blockchain "oracles" to maintain real-world state data, and smart contracts triggered using these oracles. This will replace manually measuring the emissions and submitting reports, then waiting for the authorities to verify that and maybe conduct their own audits. Data from sensors and satellites will automatically be updated into the oracles on the blockchain to act as "truth" for verification.

And smart contracts for rewarding carbon credits or purchasing them will automatically execute once certain real-world conditions are met, on behalf of the participating individual or organizations. This brings accuracy, real-time execution, and freedom from human error and corruption to carbon credits markets. It can be costly, time consuming and require advanced skills to implement. But those one-time efforts and investments will incur recurring profits and advantages by automating the measurement and distribution of carbon credits.

Summary: Accurate and timely measurement of real-world events and distribution of carbon credits can be automated and facilitated using sensors, oracles and smart contracts. This can remove many impediments like human corruption and delays, and help conquer the complexity in supply chains and nature.

#6 Carbon Credits Suffer From Double Counting and Attribution Errors

The tendency to deal with the complexities of complex supply chains and natural processes, is to oversimplify the carbon accounting. A finished product can comprise parts and raw materials coming from various corners of the world. How to attribute the carbon footprints of the different entities involved in the manufacturing and transporting a given product? Firstly, we need to properly map all the complex supply chain networks involved in a product. Then, we need to proportionately attribute the total emissions of this network towards the carbon footprint of individual entities. Both these steps have a good scope for being oversimplified. This can lead to double-counting problems with legacy carbon credits. Here, multiple entities receive carbon credits for the same emission reductions. For example, instead of distributing 1 carbon credit among 10 entities, we give out 10 carbon credits.

What that causes is that we get higher carbon emission reductions on the paper, while the real world still has plenty of carbon emissions affecting climate change. Polluter entities can thus earn more carbon credits than they deserve because of such double-counting. If we convert the legacy carbon credits into carbon credit crypto tokens, we can remove the chance of multiple entities being able to claim the same carbon emission reduction multiple times. You may recall this is a fundamental property of blockchain. It is a decentralized public ledger of transactions that by its design prevents double-spending of any token.

But we must also be careful about the tokenizing process. If we don't retire off-chain credits while tokenizing, a given carbon credit will simultaneously exist as a crypto token and as a traditional certificate. This will specifically cause double-counting. Hence, while bringing a carbon credit on-chain, we must take care to retire or delete the old or off-chain credit.

Summary: Double-counting of carbon credits due to complexity of supply chain and natural feedback loops can be prevented with the help of blockchain which by its design prevents double-spending. We must tokenize the legacy carbon credits, that is bring them on-chain, and simultaneously retire the off-chain or legacy credits.

#7 Solving Climate Change Requires Collaboration and Collective Action

Finally, we must acknowledge that the global and complex problem of Climate Change will always throw new challenges at us. We can innovate in our technological capabilities, and improve the rigor of our implementations. But Climate Change and related crises will continue to be exceptionally hard problems. At its fundamental layer, every social or collective problem is a problem of co-ordination and communication. We have been using obsolete hierarchies and bureaucracies to organize ourselves. In such topologies, information doesn't reach the right nodes in the network at the right time. There are unnecessary wait times. This reduces our collective resilience and adaptability. We react and change too slowly, as we allow the inertia of old processes and customs to slow us down.

Blockchains and Web3 offer us new ways to effectively use decentralization to improve many of our suboptimal system designs. Traditionally, we have had representative democracy and waterfall models with slower, longer cycles of iteration. Our governance strategies can become more like participative or liquid democracy and agile development with rapid prototyping and sprints.

For ages, central authorities have become bottlenecks in decision-making. Instead, we can empower individuals and small groups to take ownership of their local resources and problems. In the past, censorship and corruption among the gatekeepers has kept valuable information from the public. Instead, peer-to-peer communication can ensure rapid and unrestricted transfer of knowledge and updates. We can improve our problem-solving and collaboration capabilities manifold by applying decentralization technology. For carbon credits markets, we can combat global inquities and liquidity issues with global crypto markets and liquidity pools. Public blockchains, decentralized automated organizations or DAOs, oracles and smart contracts bring transparency, automation and efficiency.

Summary: Blockchains and Web3 give us the powers of decentralization, censorship-resistance and peer-to-peer collaboration. With them, we can radically improve our resilience, adaptability and collaborative abilities while solving Climate Change and related crises.